In this Loopring price prediction and review article we will take a look at one of the most interesting innovations in the crypto space.

In the fast-paced world of cryptocurrency, innovation never sleeps. One such innovation is Loopring, a project that’s making waves by enhancing the way we trade digital assets. But what exactly is Loopring, and why should you care? Let’s dive in and unravel the story behind this intriguing application and its role in the crypto universe.

What is Loopring?

Loopring is a decentralized exchange (DEX) protocol designed to optimize trading efficiency. At its core, Loopring aims to make trading cryptocurrencies faster, more secure, and more cost-effective. Unlike traditional exchanges that act as intermediaries, Loopring operates on the Ethereum blockchain, enabling users to trade directly from their wallets.

Loopring was founded in 2017 by Daniel Wang, a former Google engineer. The project was created to address some of the major issues facing traditional exchanges, such as high fees and slow transaction speeds. Since its inception, Loopring has grown significantly, attracting attention from both individual traders and institutional investors.

In 2019, Loopring launched its first version of the zkRollups technology, marking a significant milestone in its development. This technology allows for high-throughput and low-cost transactions, which has been a game-changer in the world of decentralized finance (DeFi). Loopring is a Layer 2 solution for Ethereum using ZK (zero-knowledge) rollups. It was the first project to implement this technology.

Key Features of Loopring

Decentralization: Loopring eliminates the need for a central authority by leveraging smart contracts on the Ethereum blockchain.

Order Matching: It uses a unique algorithm to match buy and sell orders, enhancing the efficiency and speed of transactions.

Low Fees: By utilizing an advanced mechanism known as zkRollups, Loopring can reduce transaction fees significantly compared to other platforms.

How Does Loopring Work?

Loopring functions through a concept known as zkRollups. This is a layer-2 scaling solution that bundles multiple transactions into a single batch before settling them on the Ethereum blockchain. This method not only speeds up transaction processing but also lowers costs, making trading more affordable.

Order Matching: Users place orders, which are then matched by the protocol. This process occurs off-chain, meaning it’s faster and doesn’t clog the Ethereum network.

Batch Processing: Orders are grouped together and processed in bulk using zkRollups.

Settlement: The final batch is settled on the Ethereum blockchain, ensuring all trades are secure and transparent.

Usage and Volume Statistics affecting Loopring price prediction

Loopring has seen moderate growth in its usage and trading volume. As of the latest statistics:

Trading Volume: Loopring consistently handles millions of dollars in trading volume, reflecting its strong adoption and trust within the crypto community, all the while it has potential for more.

User Base: The platform boasts a growing number of active users, with thousands of trades executed daily, and, as mentioned before, there is potential and need to grow the usage.

Transaction Speed: Loopring’s zkRollups technology can process thousands of transactions per second, a stark contrast to the limited throughput of many traditional exchanges.

Analysis and Loopring price prediction

Loopring aims to combine centralized order matching with decentralized exchanges (DEXes). It’s known for being cost-effective compared to Ethereum, with the ability to process around 2,000 transactions per second.

Headwinds

Usage: Current usage of Loopring low. The data shows weak adoption, and the Loopring Zone exchange has limited trading volume and markets.

Limited strong partnerships and lack of significant projects building on Loopring.

Tailwinds:

- Vitalik Buterin’s endorsements have historically boosted Loopring’s price.

- Potential for Loopring’s Layer 3 solution to drive future growth.

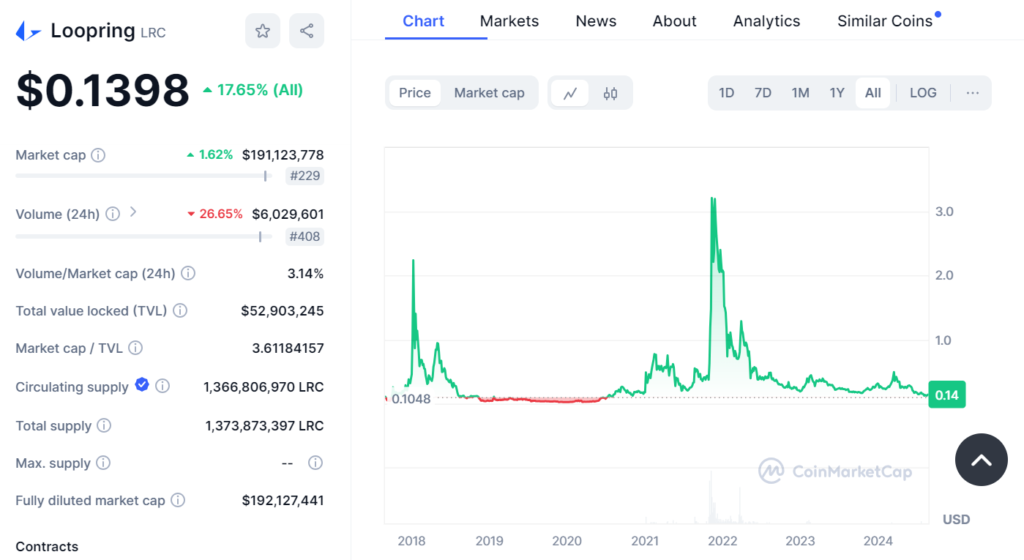

- Historical Performance

- Loopring’s all-time high was $3.83, and if the long-term uptrend continues, it could theoretically reach $5.

It’s currently standing at $0.1398, and allthough, I don’t believe there will be a spectacular rise in the short term, there is absolutely a lot of potential for a long term rally.

If the Layer 3 solution gains traction and if Vitalik Buterin endorses it, significant price increases are possible.

Conservative Loopring price prediction: Given current statistics, price action, and usage data, I would be cautious and estimate that Loopring might only reach around $1 to $2 in the near term.

Best case scenario: If Loopring’s Layer 3 is widely adopted, and if Vitalik Buterin promotes it again, the price could potentially reach $5 or more.

Loopring Price Prediction & Review Conclusion

When it comes to estimating Loopring’s price potential, I would say that we should be cautious optimists, especially taking into account the upcoming bull cycle, which could be triggered in September by a couple of catalysts.

Make sure you review your crypto portfolios, especially in anticipation of potential market changes due to monetary policy shifts.

But, if you want to see which cryptos we have our money in, check out Copy my Crypto. Unlock your potential with a single dollar! 🚀 Dive into the world of crypto with a proven strategy that’s already changing lives. For just $1, you’ll gain access to an exclusive offer that could transform your financial future. Don’t miss out—join thousands who are already on the path to success. Click here now and start your journey to financial freedom! 💸💪 Unlock Your Crypto Future.

Happy investing!