This HIVE coin review is an explanation of the Hive cryptocurrency that we have written to help you better understand the Hive Blockchain and Ecosystem

Hive Coin Review – What is the Hive blockchain

The Hive blockchain is a decentralized rigid fork of the “Steem” blockchain. The Hive crypto ecosystem hosts a wide range of decentralized applications (dApps), social media platforms, NFT projects, and crypto games. Additionally, Hive currency (HIVE) is the native cryptocurrency of the Hive network and plays an essential role in the Delegated Proof of Stake (DPoS) consensus mechanism. Plus, thanks to the new Proof of Brain (PoB) concept, anyone can earn Hive Coins by creating and organizing content.

Blockchain technology is at the forefront of a new financial paradigm. However, to fully assess reality it is important to first understand where we are going.

What is Hive (HIVE) and how does it work?

Hive is a fast and scalable blockchain ecosystem based on DPoS for Web3 and a hard fork driven by the Steem blockchain community. The platform hosts a wide range of decentralized applications (dApps), APIs, development tools, and front-ends that aim to make it as easy as possible to integrate blockchain solutions, manage records, and access data on-chain.

Additionally, the Hive network serves developers, investors, creators, and consumers. As a result, the network is capable of storing large amounts of highly accessible content and data made available for “time-based monetization”. Plus, Hive’s blockchain delivers ultra-fast transaction confirmations in under three seconds with no fees. This makes the platform highly scalable, lowering the barrier to entry and promoting the mass adoption of blockchain technologies.

The native Hive currency (HIVE) benefits from the new concept of PoB which distributes a portion of the inflation to network users. Additionally, Hive offers a variety of activities for users to earn passive income without financial investment. This includes playing games, blogging, using dApps, and creating and participating in discussions.

Hive Coin Review – The Steem blockchain

Steem is a social blockchain that facilitates instant revenue streams by sharing user-generated content. In March 2020, blockchain Hive was released as “an independent and decentralized fork of the Steem blockchain”. While Hive aims to uphold the values of the Steem platform, it also aims to free the community from “the burden of Steemit Inc. and its disproportionate influence”. Following this fork, all Steem users were “thrown into the air” from a mirror of their current Steem balances to an automatically created sub-account in Hive. Additionally, the Steem users were able to log into their new Hive accounts using their existing Steem account keys.

Also, according to “Dapp.com”, Steem’s daily active users dropped 17% after the fork. According to Hive, following the sale of Steemit Inc to Sun Yuchen of the Tron Foundation, “the exploitation of that influence and the loss of faith in Steem’s continued profitability led to the creation of the Hive blockchain.”

PoB

Proof of Brain (PoB) is a type of token that can only be earned as a reward for posting and selecting content. Additionally, the PoB token has a maximum supply of 21 million tokens without “pre-mining” and is subject to a 50% reward reduction every four years, just like Bitcoin. Additionally, the PoB encourages the adoption of censorship-resistant social media platforms. Likewise, participants in the Hive crypto ecosystem can earn passive income by publishing videos, blog posts, and other types of content.

Hive Coin Review – Technical vision

Hive aims to create a robust enterprise-grade blockchain solution that reduces operating costs and constantly strives to improve. In addition, the project is committed to developing a wide range of libraries, community resources, and development tools to make it easy to integrate blockchain infrastructures.

Additionally, Hive is building a multi-tier solution that features modular plug-ins for blockchain and tier 2 application tiers. Additionally, the platform is seeking to create an ecosystem of “censorship-resistant by design” services and products. This includes standardized microservices for continuous layer 2 integration, non-fungible tokens (NFTs), social media applications, and token management tools.

Hive technology and scalability

Hive’s support for large volumes of transactions, combined with its fast 3-second block times and free transactions, makes it an ideal platform for building highly interactive applications that would bog down most blockchain networks. It also has a unique focus on second-tier architecture to distribute application loading across distinct side chains to enable scalability beyond the boundaries of traditional smart contract networks.

To mitigate scalability limitations, proponents of an application can allocate additional CPU resources as needed in the second tier to power their favorite applications, without worrying about congestion from other applications on the network, but still benefit from a common blockchain backbone to ensure the integrity of the distribution data. This scalability also allows for a unique competitive landscape for application developers.

The Hive crypto ecosystem

There are two classes of cryptocurrencies in the Hive network. First, the native Hive currency, and secondly, “Hive Backed Dollars” (HBD). Each of these assets plays a vital role in Hive’s entire crypto ecosystem.

There are two classes of cryptocurrencies in the Hive network. First, the native Hive currency, and secondly, “Hive Backed Dollars” (HBD). Each of these assets plays a vital role in Hive’s entire crypto ecosystem.

Hive Coin Review – HIVE token

The Hive currency, or HIVE, is the native cryptocurrency of the Hive blockchain and exists in two forms. The first is the hive’s liquid coin and the second is a form of staking called “Hive Power”. Hive currency is freely negotiable and can be bought, sold, and played. However, Hive Power is made available to stakers after a period of maturation in a process known as “power up”. After this process, Hive Power is converted back into liquid Hive coins over the course of 13 weeks in a process called “shutdown”.

Initially, Hive Coin Supply was based on a snapshot taken at the time of the Steem hard fork that created the Hive blockchain. After a 51% attack on the Steem network, all Steem stakers, except those involved in the attack, received a distribution of Hive coins that reflected their Steem balances.

One of the main features of the monetary policy of the Hive currency is the decrease in the inflation rate, which decreases by 0.01% every 250,000 blocks. This equates to approximately 0.5% per year. Of the coins that come into circulation via inflation, 65% will fill the bounty pool for content creators and curators. Another 15% will go to Hive Power stakeholders, while 10% will go to the “Decentralized Hive Fund” (DHF) and block the rewards.

Hive Backed Dollars (HBD)

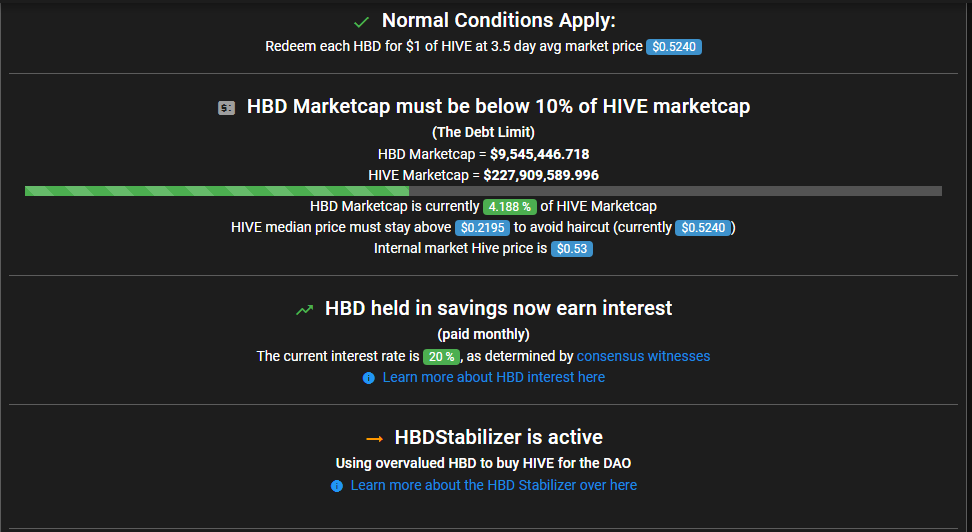

“Hive Backed Dollars” (HBD) is a dollar-indexed stablecoin used throughout Hive’s crypto ecosystem. In addition, they are “supported by the network’s ability to convert them to HIVE $ 1”. Additionally, the market capitalization of HBD must remain below 10% of the market capitalization of the Hive currency to maintain a sustainable economy. Additionally, the average price must remain above $ 0.3964.

Hive Coin Review – The Downside

It is precisely within HBD that we see the only potential problem when it comes to HIVE.

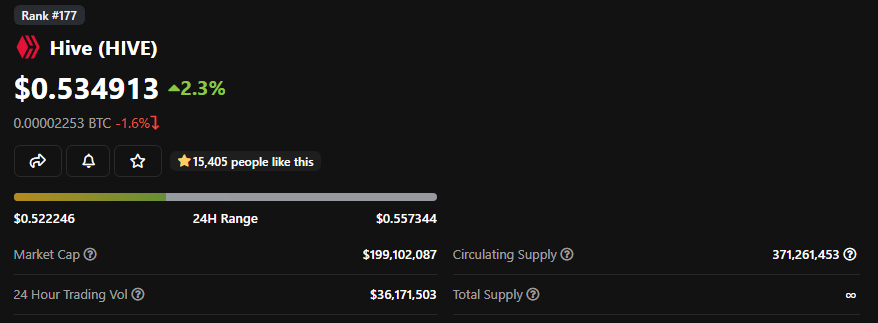

Right now HIVE is at 0.534 cents, with a $200 million market cap. They had achieved highs of around 3$ earlier this year.

HBD is their native stable coin designed to maintain the 1:1 Dollar ratio. However, they’re set up in a very similar way to Terra in order to achieve the goal of pegging to one USD.

The operation converts set amount of HBD to one us dollar worth of hive with no extra

fees. It takes three and a half days for the conversion to finalize. The price in this conversion is the median

price for the coming three and a half days to prevent market manipulations, which, hopefully, stops the potential for the Terra Luna situation.

You can redeem each HBD for one dollar worth of hive at three and a half days’ average market price, but HBD’s market cap must be below 10 of Hive’s market cap. And they point out that Hive’s median price must stay above 21.27 cents to avoid a haircut.

That in itself could be a problem if people start dumping on Hive; then the haircut that would happen

particularly with regards to HBD would be pretty brutal.

As the HBD market cap rises, if Hive’s actual native crypto capitulates, the probability of the median price staying above the target point reduces, and it’s not been exactly the most stable of coins.

Presuming that the three-and-a-half day period prevents the manipulations enough that they shouldn’t have the issue that Terra had with the attacks, even that doesn’t protect them from Hive’s price capitulating.

I think they’re susceptible to serious market losses, especially with the upcoming recession. My advice is not to hold all your assets in HBD just in case things go for the worst, although the 20% interest is an understandable incentive.

Conclusion

Hive’s blockchain aims to drive the mass adoption of cryptocurrencies and blockchain technology by encouraging engagement with multiple decentralized applications (dApps) across the entire Hive network. In addition, the platform offers a wide range of tools and services for developers, content creators, and businesses to create compelling dApps and decentralized social media platforms.

With zero gas rates and super-fast transaction confirmation times, Hive’s blockchain is highly scalable, with a low barrier to entry. Additionally, the Hive network hosts over 126 projects, including many interesting decentralized social media platforms, game crypto platforms, and NFT projects. These apps are helping to build decentralized communities, rewarding users for participating in discussions and creating valuable content.

If you want to find out which cryptocurrencies we are holding, which ones we will invest in, and which to stay away from, we strongly suggest checking out Copy my Crypto.