Dubbed “The DeFi Hub of Polkadot”, Acala Network is sure to be a household name and will be in the future. Lets identify the potential and investment opportunities that this project offers in the coming period.

What is the Acala network?

When creating Acala, the developers of this project had the ambition to turn the project into an all-in-one decentralized financial center on the Polkadot network.

While running on the Polkadot platform, the platform is also compatible with the Ethereum network, from which you can leverage the power of smart contracts on Ethereum and take full advantage of decentralized applications. The dApps are available on the Ethereum network.

In addition, the platform offers a wide range of financial applications, including: derivative application for DOT – LDOT (liquid trustless DOT staking derivative), Acala dollar stablecoin backed by a cross-asset chain (aUSD), and decentralized exchange AMM – all with very small gas charges during transactions.

What’s great about Acala Network?

Acala Network shares Polkadot’s security infrastructure solutions, so this can help protect the platform from external attacks and facilitate easy system upgrades.

Here are some of the highlights:

Acala EVM

Acala’s Ethereum virtual machine is specifically designed to help provide solutions for Substrate, Solidity and Web2021 developers to experiment with different applications with a single wallet.

Additionally, Acala’s EVM enables decentralized applications (dApps) deployed in Acala to seamlessly interact with cross-chain resources.

Acala Token (ACA)

The ACA token is the native token of the project and has two main functions in the Acala network.

First, ACA acts as a utility token. ACA is used to pay transaction fees for smart contract applications that operate across the Acala ecosystem. Secondly, the ACA is used in project management.

ACA holders are granted voting rights on key network issues. Also, they are used for stakeout and other basic operations.

Acala Dollar (toUSD)

Acala Dollar (aUSD) is a cross-chain asset-backed stablecoin: this is considered the key to improving the user experience when using decentralized applications (dApps) and centralized decentralized finance (DeFi).

This helps create a reliable storage location. Acala Network also provides various ways to increase profits using aUSD using Acala Mandala.

Decentralized Asset Fund

The decentralized wealth fund (dSWF) is a long-term economic model that uses collateral that can secure the future growth of the Acala network. dSWF’s goal is to help Acala become a self-sustaining network. This means that control of the network is in the hands of the ACA token holders.

Using its cryptocurrency reserves, Acala dSWF will help the community come together in R&D and secure a chain link position for the Acala network.

Acala mandala

Acala Mandala is the headquarters of Acala’s decentralized financial applications. However, in order to interact with this application, users must be using the Polkadot network.

Once successfully connected to their decentralized wallet, users will be able to interact with the application simply with features like: borrow aUSD, exchange, stake LDOT, governance, liquidity mining, etc.

Tokenomics ACA

Metric key

Token Name: Acala Network

Symbol: ACA

Blockchains: Ethereum

Standards: ERC20

Contract: Update

Total supply: 1,000,000,000 ACA tokens

Assignment of tokens

Acala team: 20.25%

Supporters: 10.8%

Early supporters: 18.33%

Community: 50.62%

Evaluation of the potential of the Acala Network (ACA)

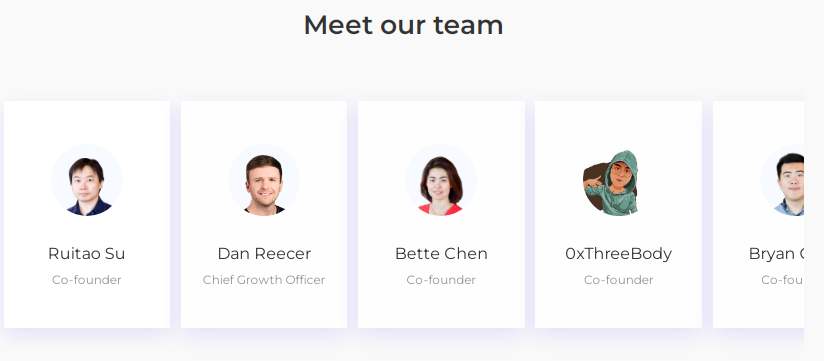

Development team

The founding team of this project all have many years of experience building projects on the current cryptocurrency market. Typically Ruitao Su or Bette Chen from the Laminar project, plus Fuyao Jian or Bryan Chen from the Polkapallet project, etc.

You can read our Acala (ACA) price prediction HERE.

Acala Network Summary

With the participation of large investment funds in the market such as Coinbase, Pantera or Web3 Foundation, together with the rich experience of the founding team, we can be somewhat sure of the development of the project.

However, we still have to spend a lot of time monitoring the development progress of the project in the future.

If you want to see which coins we are investing in, and which ones will be the best gainers in the next bull cycle, make sure you check out Copy my Crypto.