Ethereum price prediction is certainly one of the positive forecasts for short-term, and long-term investments as well. It’s been one of the rare coins that hasn’t suffered a dramatic price drop during the recent market retracement, and one of the pillars of my portfolio.

What are Ethereum and Ether (ETH)

Launched in 2015, Ethereum is an open-source digital asset running on a decentralized platform. Its founder, Vitalik Buterin, aims to revolutionize cryptocurrencies beyond simple payment technology. The Ethereum blockchain runs on its native self-application programming language, Solidity, and allows developers to create smart contracts and decentralized applications (DApps).

The technology that is contributing to the recent rise in non-fungible tokens (NFTs) has been used. ETH is the native token of Ethereum, nicknamed “the king of altcoins”, with a market capitalization of over $ 286 billion. ETH is commonly used to pay for transaction fees and calculation services. Developers can write smart contracts that receive, hold and send ETH, while users can exchange ETH.

Ethereum price prediction

Ethereum is the second most valuable cryptocurrency in the world after Bitcoin, and if the Dogecoin or Bitcoin value turns out to be very high, Ethereum travels between sharp drops and excellent recoveries, climbing the top rather quickly.

Those who expected significant investments cited Ethereum’s technological advantages over Bitcoin, particularly how it is able to power a new wave of decentralized finance (DeFi) applications. Therefore, many of those who wondered how to buy Bitcoin are re-evaluating their goals.

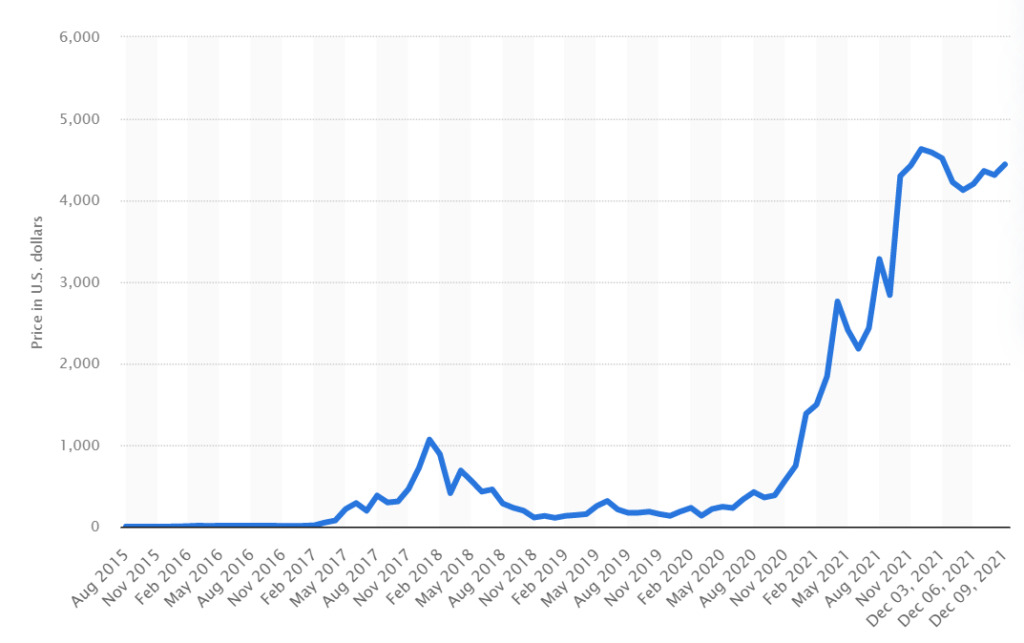

Ethereum has had exponential growth in recent years, which has made it the direct competitor of the more famous Bitcoin. A long-term uptrend, which has led it to increase its value by over 300 times in just 4 years, an increase beyond our wildest expectations.

If at the end of December 2020 its price was $756, in December of 2021 it reached a value of $4,628, becoming the protagonist of an unprecedented surge, probably driven by the growth of Bitcoin and cryptocurrencies in general. What will happen in the next few years and what is the Ethereum price prediction by 2025?

How has Ethereum grown over the years?

From its release on trading platforms until March 10, 2017, Ethereum had an average value of 11.92 dollars, then becoming the protagonist of a positive trend that led it to register a + 2,105.5% in just one year, standing at $ 503.76 despite the collapse of the cryptocurrency market in the same period. Its peak in 2018 was € 1,066.27, recorded in January.

Staying stable during 2019 with an average value of 261.33 dollars, in line with forecasts, Ethereum recorded a new growth of 1,200% from March 2020, after returning to pre-2018 values (its minimum was $ 148.20, registered in March). There are essentially two reasons for the positive trend:

- Collapse of the markets due to the CoViD-19 emergency and the search for alternative investments

- Growth of cryptocurrencies in general, especially Bitcoin in conjunction with its halving in May 2020

According to the Etherscan analytics platform, as of December 2020, there are over 350,000 contracts with ether tokens and 829 open-source projects based on them.

What is the Ethereum price prediction for 2022 and subsequent years?

According to many experts and EFA ( Economy Forecast Agency ), there will still be an upward trend but with numerous fluctuations over time:

$ 5,466 at the end of December 2021

$ 16,386 at the end of June 2022

$ 18,860 at the end of December 2022

$ 18,709 at the end of June 2023

$ 16,136 at the end of December 2023

$ 9,397 at the end of June 2024

$ 10,511 at the end of December 2024

$ 13,428 at the end of June 2025

Thanks to the rapid evolution of DeFi , which is revolutionizing the cryptocurrency scenario, to create this strong bullish trend also confirmed by the forecasts there is also the birth of dedicated ETFs: by physically replicating Ethereum, they obtain increasing space in regulated exchanges. Also noteworthy is the new Berlin update on the blockchain, which will further reduce investment fees.

My personal opinion is that next year will not be so bullish. We are in an extended bullish period, and many investors think/hope that it will last until July or August. Personally, I don’t think it will last that long. I believe that the best-case scenario is an extension of the current period to March, or April when I expect the imminent bear cycle to hit the market.

That’s why I disagree with an overtly optimistic Ethereum price prediction of $18K at the end of next year. Although Ethereum is one of the strongest projects in the crypto market, and it has shown resilience even when Bitcoin dropped to $47K, it will not be untouched once the next bearish cycle kicks in. The retracement might not be as dramatic as the other altcoins, but it will go down.

That’s why my personal strategy will be banking profits on all the coins in my portfolio whenever I can, so I can prepare a solid investment budget for the “bears”. And make no mistake, the next bear cycle will be one of the best opportunities to get into crypto with huge potential.

Is it worth investing in Ethereum in the short and long term?

Observing the Ethereum forecasts for 2022 and the next few years, we see a highly positive and unprecedented trend, which exceeds those of Bitcoin that occurred during its halving. This makes it one of the most interesting and unique investment opportunities, as well as one of the most important in the DeFi landscape, strong in advanced and constantly evolving technology.

Despite increasingly fierce competition and in step with the times, the system created by Buterin in 2015 has a solid and still implementable structure, which will give space to new developments in the name of security and value, as well as the future Ethereum 2.0 project: this is the makes a valid investment both in the short and long term, in bullish and bearish positions, also through the new ETFs.

Decide how much Ethereum you want to buy

When you see stocks of huge price jumps, it can be tempting to invest every penny you can get your hands on. But what would you do if that currency went bankrupt tomorrow and you lost everything?

Look at the choices

Cryptocurrency values can drastically rise and fall. That is why it is advisable to only invest money that you can afford to lose. Try to invest long-term so that you can overcome any major dips. If Ethereum’s price goes down, you don’t want to be forced to sell your assets at a loss because you need cash.

Research Ethereum and decide if it fits well with your overall investment goals. Ideally, your crypto should be part of a larger portfolio that balances higher-risk investments with safer ones.

Find a safe cryptocurrency exchange or broker

Almost all cryptocurrency exchanges will sell Ethereum as it is such a popular coin. If you’ve never bought cryptocurrencies, find an exchange that accepts fiat (traditional) money, such as US dollars or euros.

Ethereum price prediction – Conclusion

The cryptocurrency market is getting more and more used to the recent drop in prices despite only 13 days after the start of the new month. A few days ago, before the bearish run, people were happy that November ended on good terms. Investors were thrilled that the cryptocurrency market would grow even more in December.

We still have 18 days to go in the month; as the holidays approach, forecasters predict the resurgence of major cryptocurrencies, and Ethereum is surely among these.

The Ethereum price prediction is therefore positive. This goes for both short, and long-term investments.

One thing that I always try to stress is that you should never focus all your investments on one cryptocurrency. It is very important to diversify to be able to protect your money as much as possible. Also, the real money is in the smaller coins with great potential. If you’re lucky, you could find a coin that will go 1000x, and then you’d be set no matter how well Ethereum performs.

If you want to see how I created my portfolio, and which coins are the best investment opportunities, then I strongly suggest that you take a look at Copy my Crypto.

To your success!

DailyMoneyTree