How to pick cryptocurrency that could 100x or more? A lot of people think the ability to find a crypto coin that will allow them to make big profits is very hard, and takes a special skill reserved to only few experts.

The truth is that, even though it’s tedious and meticulous work, finding a good low cap cryptocurrency is a pretty straightforward process. There are certain steps that will allow anyone to deep dive into any crypto, and get a pretty good idea of the coin they’re analyzing.

Of course, if you’re looking for a cryptocurrency that will make you the most money, you have to focus on the low-cap coins, and that is a higher-risk investment. So, make sure you measure your risk.

Without further due, let’s dive into how to pick cryptocurrency that could 100x, 1000x…

How to pick cryptocurrency that will make you rich?

There are 6 basic, mandatory steps that I never skip when I’m looking for a good crypto investment. Naturally, the more research you do, the better. So, if you expand the analysis to more steps that will only benefit you in terms of making a better, more educated decision.

Firstly, before diving into analysis, get up Coingecko or Coinmarketcap so you’ll have the list of cryptocurrencies in front of you. Coingecko and Coinmarketcap are my favorite because of the clarity and loading speed, but you can use other sites as well.

Step 1

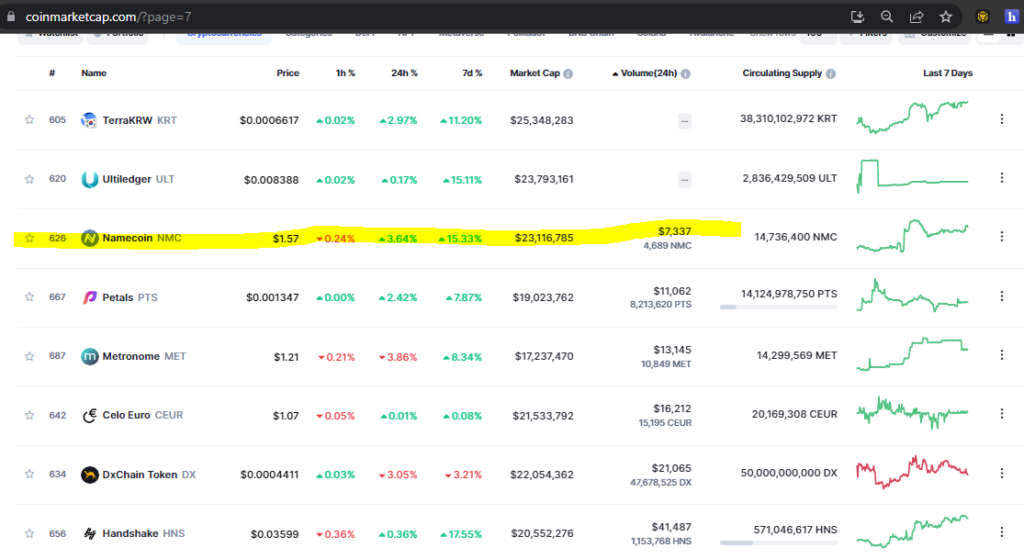

The first thing I look at is the daily trading volume. Often you can see a coin doing phenomenal in terms of the price, but when you look at the trading volume anything below 500K you’re running the risk of not being able to sell that coin.

The example below clearly shows an example of a coin having a price rally on the daily, and the weekly percentages (3.64%, and 15.33%).

It is when you look at Namecoin’s trading volume that you can see a red flag.

Remember: an investment is great if it makes you good returns, but you’ve got to actually be able to sell it, so the trading volume has to be high. Also, look at the average because a low daily trading volume could simply mean that the crypto you’re looking at is having a bad day (which is a very rare case).

Step 2

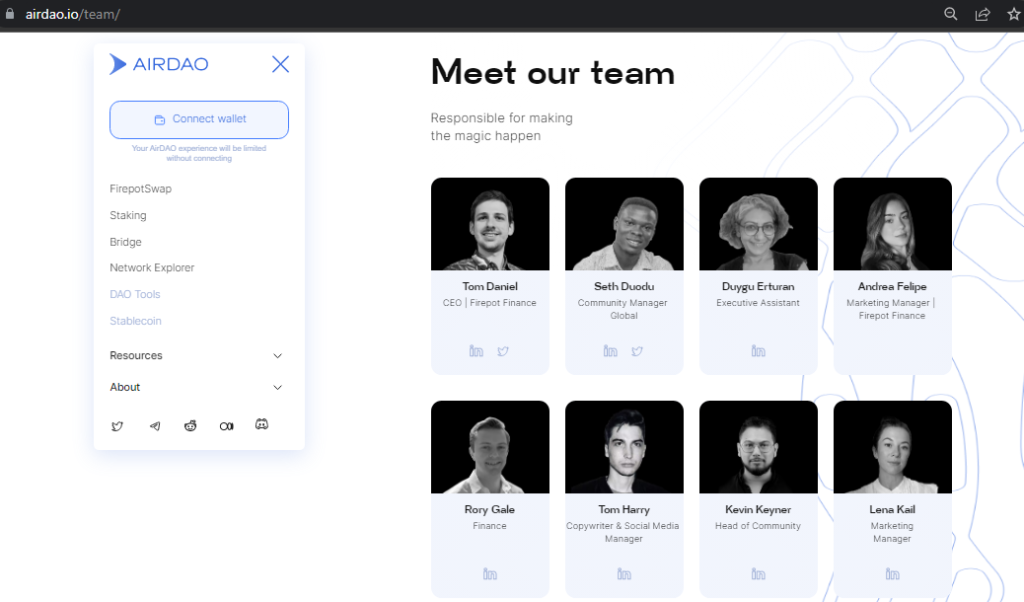

The next when you’re looking at a project is to look at the team behind it. Very rarely do i invest in anything without being able to see the team.

Ideally, you are looking for people who have prior experience on strong projects, a significant career in the field, and a documented history of success.

Step 3

The third thing we are looking at when we want to find a good cryptocurrency to invest in is the sector. What sector are you looking to invest in? There are tons of different sectors in crypto, so you’ve got to identify which one you want to invest in. Whether it’s NFTs, gaming, DeFi, DEX, AI, smart contract platforms, etc.

All of these things matter because you are going to be looking at how they differ from the competition.

Step 4

The fourth step (or point in this case) is looking at low market cap cryptocurrencies. Those are the ones that will bring the biggest gains. Obviously, there are plenty of coins in the top 100 that are going to have a huge run, but the ones that can make life-changing profits tend to be below the top 500. However, that does mean there’s a lot more inherent risk, and these cryptocurrencies are more likely to fail.

That’s why, like with any other kind of investment, you should always weight up your risk, and never invest more money than you are prepared to loose if things go sour.

Remember: the crypto market is the most volatile market out there. It can really cost you a lot if you’re not careful, but for that same reason, it is the market that can make millionares over night.

Step 5

The fifth step how to pick a cryptocurrency is to start deep diving once you’ve found a coin that interests you.

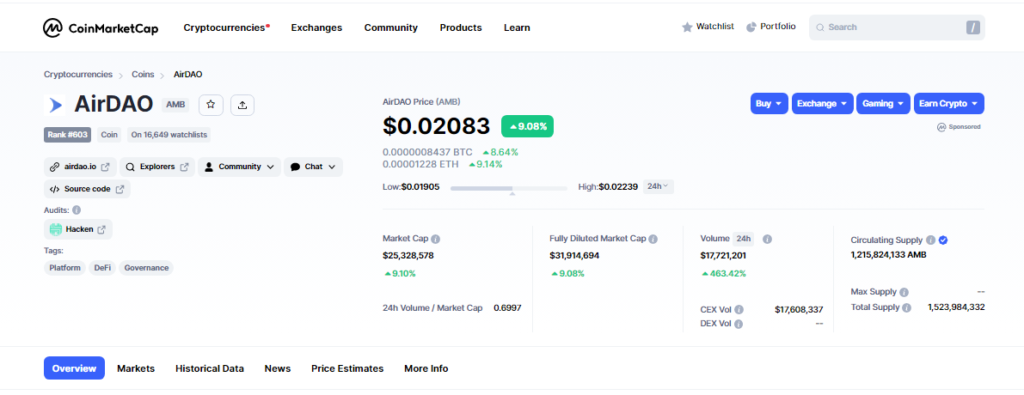

Here is a good example of a low-cap coin, with solid trading volume:

First i can see from AirDAO’s tags; Platforms, DeFi, Governance.

Before launching the App, you should find the company on Linkedin. You can check the company, and potentially the team within it.

I also use Medium articles, because they’re generally good and have a lot of useful information. Discord and Telegram are a bit too hectic for me, and I never use main media as a source of info. Mainstream media tends to be very negative towards crypto, and rarely realistic.

After you’ve looked at the basic information, go ahead and launch the App so you can find more information and check its functionality for yourself. See if the App is well designed, check for their stats like number of users, number of followers on social media platforms, etc.

Carefuly look at the ecosystem, who are they partnering with. If they are collaborating with big strong companies like Microsoft, or if it’s within the gaming sector, with Sony or Nintendo, that’s always a good sign.

You will find a lot of information and the deeper you dive into it, the more confident you will be making the decision whether you’ll invest in that cryptocurrency or not.

Step 6

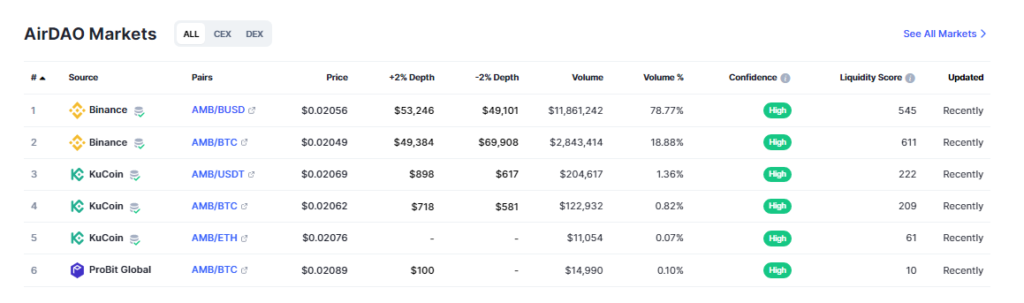

The sixth step: one thing that people don’t look at enough is the markets the crypto is on. I have no problem with not seeing any of the big exchanges like Binance or Kucoin because, actually, if you end up investing into a low cap coin, it often won’t be listed on the big exchanges.

That’s a good thing because when it lands on one of those platforms, it usually ends up having a big price rally.

A lot of people don’t want to open multiple trading accounts,a nd they just use Binance for example. You should have a minimum of three different accounts in my opinion. Personally, I have 6, but 3 is enough for anyone who ventures into crypto investing.

How to pick cryptocurrency that will 100x – Conclusion

A lot of people rely on different sources, but mainly YouTuber’s are the ones most listened to when it comes to picking crypto coins for investments. You should keep in mind that a lot of these people are sponsored by the very projects they talk about. I’m not saying that they’re lying, I’m just saying that you should do your own analysis. Only in that way you will have a complete picture of the crytpocurrency you’re thinking about investing in.

On the other hand, if you want to take the hard work out of the equation, go check out our Copy my Crypto review here. I promise youb will be impressed.