Today we’ll talk about how you can make money with altcoins during a bearish trend in terms of trading. We will go over a simple strategy, and key things to look for.

Make Money with Altcoins during a bear cycle

The crypto market has been moving in a sort of sideways pattern for the last couple of days. What I want to look at is a simple strategy that works well when the market is either moving sideways or when there’s a downturn.

Whales

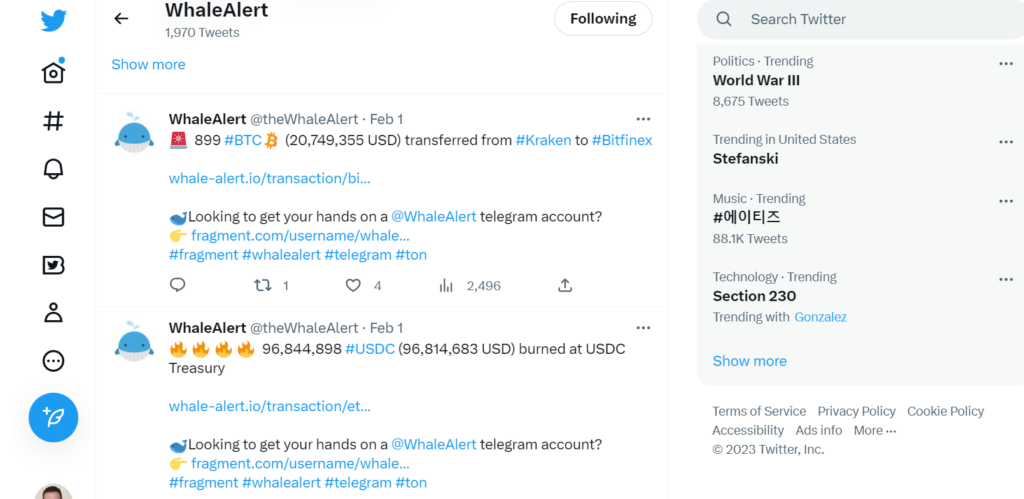

First of all, you do need to be aware of whales moving money in the market.

Cryptocurrency whales, or crypto whales, are individuals or entities that own large quantities of a specific cryptocurrency. A crypto whale is an entity that holds enough digital currency to significantly influence market prices by trading significant amounts of coins and tokens.

Here is a good example from February 1st, when a large amount of Bitcoin was transferred from Kraken to Bitfinex.

Another example that would influence the market is if someone transfers large amounts of Bitcoin or Ethereum from a wallet to an exchange. Those are signals that there’s about to be a drop, that the market is about to be shorted. Whale alerts are very useful signals that let you know when the prices are about to go down. That is a good opportunity to buy altcoins cheaper and wait for the right moment to cash in profits.

Correlation between Bitcoin and Altcoins

Another very important element that I want to point out is the correlation between Bitcoin and other altcoins.

I use Cryptowatch to check the correlation between Bitcoin and Altcoins. This is something that is mandatory if you want to make money with altcoins.

Obviously, the closer the number gets to 1, the bigger the correlation, and we know Bitcoin leads the market. If we check the 24h chart we can see that Ethereum is the most correlated at this moment.

What we keep an eye out for are the moves that Bitcoin’s about to make, or the moves Bitcoin has made

because altcoins will follow, and they almost always tend to be more dramatic. So, if you’re shorting or longing a market, you can do that with one of the altcoins that you know is highly correlated to Bitcoin.

The next thing we will have to do is to check the charts. I use and recommend Tradingview.

So, if we check out Bitcoin’s 1-minute chart, we can see that there was a significant drop at 21:47. The price dropped from $24,813 to #24,784. That’s more than a hundred dollars in a minute, so there’s a big chance that it was the whales affecting the market. The drop then continued for the next couple of minutes.

So, if we apply the same strategy to one of the altcoins that are highly correlated to Bitcoin, and look at, for example, Ethereum’s 1-minute chart at that precise time, we can see the same type of movement. Furthermore, the dip was even deeper, which is what I said before that the movements altcoins make are usually more dramatic. Comparatively, the gains that you’re going to make will be higher, especially if you’re “short” in the market.

What is shorting a cryptocurrency? When shorting crypto, the aim is to sell the cryptocurrency at a high price and buy it back at a lower price. Unlike most traders who like to buy low and sell high, short sellers aim to sell high and buy low.

When you see this kind of movement of Bitcoin, and you have a highly correlated asset like Ethereum, you should expect the correction of the dip to be more dramatic for Ethereum than it was for Bitcoin.

There’s more profit to be made, but it’s paramount to keep a good eye on the 1-minute charts.

Let’s take a look at another highly correlated crypto, Binance coin.

Again, we see a drop at the exact same time, followed by a deeper dip.

How to make money with altcoins – Conclusion

When you see a huge movement in Bitcoin, you can predict with reasonable accuracy that the same move will be made by some of the altcoins, namely the most highly correlated ones. This is an effective way to make money with altcoins, particularly in a slow, sideways market. The higher the correlation, the higher the potential for bigger moves in comparison to Bitcoin.

A very important aspect of this kind of trading is being fast, keeping eye on those 1-minute charts, and reacting at the right time.

The examples I’ve shared above are just the most recent ones for reasons of practicality. Usually, the swinging moves of the altcoins are much more dramatic.

One of the most important things is keeping an eye on whales’ movements because the moment that you see a huge inflow of Ethereum or Bitcoin into an exchange, that is the signal that there’s about to be a dump.

On the other hand, if you are seeing tons of actual capital going into exchanges (USD, USDC, BUSD…), that’s usually a signal that we’re about to see a price push and bullish momentum.

I think that these are nice little tricks that you can use to make money with altcoins during this kind of stagnant market.

Hope this article was helpful!

If you guys want to see the coins I own right now, anytime I make a trade, anytime I add or take away from my portfolio in real-time, come check out Copy my Crypto