What are the top 10 cryptocurrency predictions in 2022? How much will bitcoin be worth? How much will Ethereum grow? Is Dogecoin still worth holding on to? These are the questions I get on a daily basis, so I researched the subject and I’ll share with you in this post my predictions for the top 10 cryptocurrencies in 2022.

It’s mid-October and throughout 2021 we have seen the growth and drop of thousands of crypto coins.

It’s hard when you’re just starting out with crypto; so much to choose from, so much information everywhere (often conflicting).

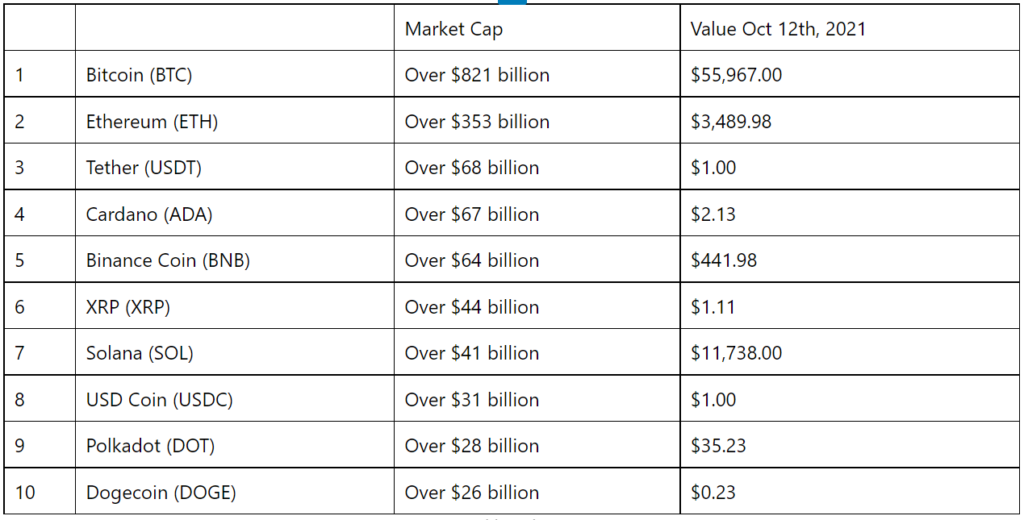

In this article, we will take the best performing cryptocurrencies in October 2021, and try to predict the values for next year.

Top 10 Cryptocurrencies in 2021

Let’s take a look at the top 10 cryptocurrency predictions for next year.

1.Bitcoin – Top 10 Cryptocurrency Predictions 2022

Bitcoin forecasting is a complex art, on which both analysts from the world of cryptocurrencies, as well as those who deal with traditional economics, try their hand.

We will deal with technical analysis and also fundamental analysis, today essential tools for those who want to try to understand how Bitcoin could move, together with other cryptocurrencies related to its performance.

Bitcoin is in a rather complex phase of its existence. We are very far from the all-time highs that saw BTC exceed the value of $ 64,000, the all-time high reached by the cryptocurrency. After a September that, as always, did not have positive repercussions on the price of Bitcoin, October opened upwards, albeit with a channel that is still apparently difficult to overcome.

Bitcoin is on the rise, as expected since October, a generally lucky month for the entire sector. At $ 57,000 we find both technical and psychological resistance that is difficult to overcome. The channel remains relatively broad in our view, even though BTC has shown incredible strength – even resisting the hints of a global crisis.

There is movement on the horizon

It started with El Salvador, which declared Bitcoin legal tender. Much more could also move in the coming months to other Central American and South American states. Something seems to be about to move on the African continent. Of course, there will be very important resistances, which have already involved the International Monetary Fund and the World Bank, which have always been anchored to the US dollar.

Bitcoin is a cryptocurrency that has been around for a decade now and that needs to be put into historical perspective to understand its potential. We are very far from the beginning phases when with 1 dollar we could buy a significant amount of coins. Bitcoin has come a long way since that phase and today its worth is astronomical.

Is it worth buying Bitcoin now? Yes, it is a good time to buy Bitcoin, although there are further considerations to be made before setting the extremes within which to move. Bitcoin, contrary to what many fake specialists say, influencers who have no knowledge of the markets and ultimately click-catcher, is not a magic money-making machine.

Making predictions on Bitcoin is very difficult. Exposing yourself opens up to the risk of blundering, especially if you don’t know what the true prospect of Bitcoin could be. I think that the price, for 2022, of $ 120,000 is realistic, which is derived both from the expectations of market operators a little over a year from now, and from my personal analysis.

2.Ethereum – Top 10 Cryptocurrency Predictions 2022

Many Ethereum investors are wondering in which direction the stock market will move in the future and, in this article, we will gather as much information as possible in order to provide reliable Ethereum forecasts. It is in fact possible to make completely realistic predictions through the detailed analysis of what has happened to the Ethereum market so far, so as to guide investments in the right direction. It seems logical to warn that all possible forecasts are, in fact, forecasts, since there is no real certainty about what will happen.

Ethereum closed last year (2020) with a value of 387 dollars and a capitalization of 43 billion dollars; subsequently, this price has undergone a real surge, exceeding 3000 dollars and a capitalization of 400 billion dollars.

This great growth has been associated by many with the positive trend that has invested in Bitcoin, while others see the two cryptocurrencies separately both in substance and in future growth.

So, what is the forecast for Etherium?

The answer to this question is the result of a series of determination to face: the ability to analyze risks, that is the awareness that investing in cryptocurrencies can always be considered a tangible risk of losing the share that has been invested; detailed analysis of moving averages and oscillators which can provide further details on the actions to be taken; the market trend, which must be followed in a specific way, especially at the end of the pandemic. In general, it can be said that investing in Ethereum is worthwhile.

Even in the long term, this cryptocurrency should give great satisfaction to its investors: it should in fact reach values between 5,000 – 8070 in 2022, continuing the positive trend that began in 2021. The idea regarding these forecasts is based on the history of the value of the major competitor, namely Bitcoin, which would go hand in hand with that of Ethereum.

Ethereum could be a good choice for those looking for diversification to invest in cryptocurrencies.

Today trading with ETH through a trading broker like eToro is an interesting choice because thanks to CFDs it is possible to invest both if the price rises and falls, so there is maximum freedom.

3.Tether – Top 10 Cryptocurrency Predictions 2022

Tether is a very particular cryptocurrency because it was born and lives as a stable coin and therefore should have its value pegged to the dollar exactly. In reality, the fluctuations around the price are minimal, in relation to how convenient it can be to hold this cryptocurrency compared to classic dollars.

In short – the value of this cryptocurrency can fluctuate by more or less 5% (this is what has historically been recorded) on the value of the dollar and therefore making predictions on USDT means first of all making predictions on the currencies represents and against which is exchanged.

Those looking for forecasts on Tether look for them in relation to the BTC / USDT pair, which sees the Bitcoin equation on one side and the stable Coin most used on the cryptocurrency markets on the other. When you do this type of analysis you are actually making a reverse prediction on Bitcoin. It pays to go back to USDT when BTC does not offer good investment opportunities and vice versa.

Those who invest in USDT are actually investing in the dollar, because as we said Tether is linked to the value of the US dollar, with minimal variations. Those who choose to invest in USDT are technically investing on the dollar.

What can be useful to understand is that Tether can also be used in the short term, to exit the cryptocurrency market momentarily and take refuge in a token that is pegged to the dollar.

Two types of technical indicators on Tether can be analyzed. That is those on the US Dollar against Bitcoin or those directly from Tether against Bitcoin. The results are exactly the same because both replicate how useful it is at the moment to buy USD (or USDT) against Bitcoin, which is the reference cryptocurrency.

Tether price prediction for 2022?

Tether will maintain its constant price level, pegged at 1 US dollar. When it comes to the medium term, therefore, it would be good to refer to the value of the dollar on international markets, also in relation to cryptocurrencies.

4.Cardano – Top 10 Cryptocurrency Predictions 2022

Cardano is not a classic cryptocurrency as Bitcoin and those that arose from a split from the main branch of BTC. In fact, it was born with the aim of providing not only a means of exchange of value but also as a platform for the execution of smart contracts on Proof of Stake systems with low energy and computational power requirements.

The first scenario to be analyzed is that of the technical factor, that is the technological advantage that ADA has compared to similar platforms. Compared to the use it offers as an exchange of value, transactions are much faster than what we find on Bitcoin. This means that as a means of payment it is technologically superior and certainly easier to use in the real world.

Compared to Ethereum, on the other hand, it offers greater scalability, almost infinite, which makes the system more resilient in case of extensive use of the same. However, this technological advantage, at least in the current cryptocurrency context, does not necessarily have repercussions on market value.

Because it will be the reach that will determine who will win both wars – that is, if Bitcoin will be more used as a payment system for those who invest, or if on the contrary, it will be Cardano’s ADA to win. Similarly, occupying at least part of the same niche as Ethereum, it will be necessary to see who will manage to win it as the dominant platform for smart contracts, which will be available on Cardano shortly.

Despite having followed the trends of Bitcoin over the medium and long term, it is difficult to think of Cardano as a cryptocurrency that is also a store of value. Therefore the overlap of the graphs must be evaluated in terms of the driving effect of Bitcoin on the rest of the market. Whoever tries to cross the stormy sea of the current economy, however, will in all probability do so by turning to BTC or BCH.

Cardano forecast 2022

The forecasts on Cardano over the medium term are enthusiastic: the consensus of analysts is in fact fixed around $ 5 , which means that within 2 years from the time of writing this article, this cryptocurrency could increase in value up to 80%.

5.Binance Coin – Top 10 Cryptocurrency Predictions 2022

Binance Coin comes from a period of tremendous growth, which has allowed it to establish itself among the top 5 cryptocurrencies by capitalization and trading volumes. This great growth is linked, on the one hand, to what is offered by the exchange of the same name, on the other to the importance that this exchange center is obtaining on the main Defi markets, or tokens that are used to represent financial and sometimes even physical assets.

Binance Coin was born in 2017 as an ERC token on the Ethereum network and then moved on its chain. From its name, we can deduce the close link with the Binance exchange, which is the official token, used to pay commissions on exchanges. A utility token that has grown in importance in the crypto world with the growth of the Binance project, which today certainly occupies a very important role even among historical exchanges.

In order to assess the price in the long run the BNB token is useful to know The Burn project, that the promise by the maintainer of Binance Coin, to destroy at least half the circulating token (100 million out of 200) to keep on the long run, the stable value. Binance, therefore, aims to operate as a sort of central bank, albeit in reverse, trying to govern expansion and de-expansion of the monetary base.

In order to evaluate the possible returns, even in the long term, of this token, it is good to underline the differences that the first generation cryptocurrencies: there is a maximum limit of tokens, which were however created at the start and which are not mined. This program, when implemented, could greatly benefit Binance Coin holders over the long and very long term. A guarantee of further anti-inflation for BNB.

There is a strong correlation both with the price of Bitcoin and with the trading volumes. The graphs on the other hand speak very clearly – and we also attach them to offer an immediately visible impact of the correlation in question. According to our calculations on the past prices of the two cryptocurrencies, we are facing a correlation of more than 70%. Very high also in the cryptocurrency sector. We can therefore consider the investment or capital commitment on Binance Coin similar, by price progression, to the investment on BTC.

Despite the huge volatility of BNB, I have researched what is the sentiment among the main analysts dealing with Binance Coin. Prices that are increasing compared to current values, despite a not exactly brilliant moment for the sector.

Binance prediction for 2022

The Binance Coin forecasts over the medium term are moderately bullish.

The Average Target Price for 2022 is around $ 650, with an important growth compared to current values, but certainly not exciting. The bargain we would make by investing in BNB today on this time horizon is on greater stability, giving up very high potential gains, as could be guaranteed by other cryptocurrencies.

6.Ripple XRP – Top 10 Cryptocurrency Predictions 2022

Making predictions on Ripple (XRP) is very difficult in this historical moment, for the cryptocurrency that aimed – and still aims – to be the reference point for the banking sector. A strong cryptocurrency on the market – but which today is having legal problems with the US market regulator, the SEC that would like to fine the company managing the project for more than $ 1 billion. However, as we will see in our in-depth study, the lawsuit is deflating, with Ripple Labs’ lawyers taking home some very important victories in the interim hearings.

Ripple is recovering from the crash due to the SEC filing. As lawyers battle it out, it becomes increasingly evident that the American market regulator actually has very little to bring to the prosecution. And this caused Ripple to regain its share, and it even broke above $ 1.75. The correction that hit the entire sector recently brought the price lower. There is a lot to recover, but the group has shoulders big enough to be able to resume a new bull run at any time. The latest developments in the process have pushed it up, even against the latest Bitcoin run.

XRP has had a relatively high correlation with Bitcoin in history. This has resulted in the system making huge profits during all BTC’s bullish runs. However, the spell broke last Christmas, just before the SEC filing was publicly announced. In other circumstances, such as Bitcoin’s more recent retracements, XRP has instead held and even increased its value.

The moment of cryptocurrencies is very interesting. The sector continues to grow on average, although in recent times decentralized finance projects and newly minted tokens have been driving. Ripple is not part of this sector and it is not certain that it will benefit from it.

The short-term indicators have spoken and point to buying as the best option we have on the table for Ripple today. However, what we will face in the coming days and weeks will be a time of high volatility, with potentially very high price swings. Although it is a rather complicated moment for Ripple and for the sector in general, I continue to believe the forecasts that see it very credible, for 2022 (and 2023) at almost double the current price. The Average Target Price at which I believe we will set XRP is $ 2.5.

7.Solana – Top 10 Cryptocurrency Predictions 2022

Solana is a cryptocurrency that has grown a lot in 2021.

The Solana blockchain (also known commonly as the Solana protocol) was introduced to compete with the Ethereum blockchain, which has brought about the current revolution, particularly with its smart contract technology that must move forward to enable the inventions of finance. decentralized (Defi), Non-Fungible Token (NFT), decentralized applications (DApps), and all the other concepts such as yield farming, liquidity mining, staking, etc.

In 2021, the Solana (SOL) token became the fastest-growing cryptocurrency and is currently ranked at position seven with a real market cap of $ 39,335,974,988. It has surpassed Dogecoin, DAI, DASH, Polkadot, VeChain, Eos, and many others.

There is a large community behind Solana and there are several developers working on it. The largest and best-known of Solana also ensures that developers have better resources to further develop the quality.

All in all, experts have positive predictions for Solana in 2022 and beyond in the future. It is difficult to make an exact price prediction. However, experts expect the price to rise both in the near and far future. At what rate exactly will the Solana go up?

2022 is seen as the turning point for Solana. By then it is expected to have finished correcting the current price slump to initiate another bullish trend similar to that seen in the better part of 2021.

In addition to correcting the collapse in prices, several partnerships, alliances, and community funding have taken place with Solana, which should push the cryptocurrency into a bullish course very soon. My prediction is that the price will fluctuate between $145,000 – $163,000 in 2022.

8.USD Coin – Top 10 Cryptocurrency Predictions 2022

Making forecasts on the USD Coin means making forecasts on the US Dollar. This cryptocurrency is actually a stable coin that is firmly pegged to the US currency. It was not born to change price with respect to supply and demand but to tokenize one of the most important currencies in the world and make it usable with smart contracts.

USD Coin can be analyzed from at least two perspectives: as a symbol of the value of the US Dollar and also as a token useful for decentralized finance. The prospects are equally twofold because on the one hand one could evaluate the commercial strength of this token compared to other stable coins, on the other hand, evaluate the path of the US dollar against the main cryptocurrencies.

If USD Coin were to increase in value, it would mean that the entire classic cryptocurrency sector would lose it.

The first thing we can say about USD Coin is that it has competitors who are currently very strong, or rather, stronger than USD Coin. Think of Tether, which has a much higher market capitalization (orders of magnitude higher). There is also Binance USD, which is used by the exchange of the same name for its internal operations.

However, what we have just said about USD Coin should not be misleading. The project behind it directly involves both the Coinbase exchange and Circle, which are responsible for guaranteeing the USDC value in dollars. They do this through the deposit of equivalent value verified by third-party companies. In a situation that is generally clearer and more verifiable than that of many other stable coins.

USDC is not an investment token (also because in that case, we could simply rely on the US dollar in other types of markets). It is a token that we use because it is useful on different blockchains to represent the value of the American national currency. So making long-term predictions on this cryptocurrency is very frivolous.

There is no need to be particularly responsive on USD Coin right now.

It is a utility token that we should think about buying if and only if it will be useful within the platform we use to trade.

Forecast for 2022?

USD Coin will always be worth one US dollar. There is very little to discuss this. What may be of interest in terms of forecasts is the adoption of this project and how relevant it will be within the cryptocurrency ecosystem.

9.Polkadot – Top 10 Cryptocurrency Predictions 2022

DOT is the cryptocurrency of the moment, which has already registered very important increases in value and which seems to have very interesting trends in front of it, even on very distant horizons in time. In the middle of project interchangeability between other blockchain and born from the same minds of Ethereum, Polkadot might be a good alternative for your investment portfolio.

Polkadot’s DOT is not a classic cryptocurrency. In fact, it was born with a specific goal and to solve a technical problem that, in the world of cryptocurrencies, has so far prevented further developments. It is in fact used as a means of payment for transactions on the Polkadot network, created to allow the intercommunication of different blockchains, for the transfer of tokens, data, and even contracts.

It is very useful and part of its value can be linked to the use of the platform that supports it. A platform that is already enjoying great successes and that is establishing itself as the true transactional network for the crypto world.

The solution offered by DOT within the Polkadot network is technologically advanced. The technology offered by this network is unmatched today and is rapidly gaining ground within the sector.

This technical advantage is also accompanied by rapid penetration, which projects that will arise in the future will certainly not be able to have, at least within the same time spam. We are facing a project that today has a great technological advantage over the competition, which today is still at a primordial stage of development and market penetration.

For now, Polkadot is not a store of value and cannot be one by its very configuration. I, therefore, believe that this token, DOT, should be considered as a utility tool, with the intent of a network that allows us to do something that – this is very important – could not be done until Polkadot arrived on the market.

It is now convenient to buy Polkadot, despite the rally in recent months which has greatly increased its value. Today, focusing on this cryptocurrency means putting one of the most interesting projects in your portfolio, also taking into account the coming months and years in the cryptocurrency sector.

The medium-term forecast for Polkadot for 2022 is very encouraging. I believe that an Average Target Price of around $ 100 is credible, which would still mean an important gain compared to the current values, which come after a long run, which has seen DOT growing for several weeks.

10.Dogecoin

The predictions on Dogecoin are among the most difficult to make, given the very particular nature of this token.

Those who follow the world of cryptocurrencies may not have ever been interested in Dogecoin. A decidedly specific cryptocurrency, born as a game 8 years ago and has become, with several waves, one of the most popular memes on the internet. Furthermore, the price has certainly been altered several times by waves of purchases, pushed by Elon Musk and other very popular characters on the internet.

The forecasts on DOGE, therefore, will have to be taken with a further pinch of skepticism, because as is already known, the price does not always follow the rules applied to the analysis. On the technical side, I don’t have much to say about this cryptocurrency, which over time has proved to be rather useless – compared to the others – and without a great commercial impact.

Everything within the world of DOGE is a full-fledged joke. Also the name of the first signer of the white paper – Shibetoshi Nakamoto, which is a fusion between the name of the popular inventor of Bitcoin and Shiba Inu, the dog represented on the token.

What is not a game is the over 5 billion dollars of capitalization that the token has reached over the last few weeks. There are no technical improvements made to Dogecoin, which is yet another useful token for quick payments. On the other hand, expansion within the main commercial projects has never been the priority of the project.

Conclusion

So, these were my top 10 cryptocurrency predictions for 2022.

| Prediction for 2022 | ||

| 1 | Bitcoin (BTC) | $90,000 – $120,000 |

| 2 | Ethereum (ETH) | $5,000 – $8,068 |

| 3 | Tether (USDT) | $1 |

| 4 | Cardano (ADA) | $3 – $5 |

| 5 | Binance Coin (BNB) | $580 – $650 |

| 6 | XRP (XRP) | $2.50 |

| 7 | Solana (SOL) | $145,000 – $163,000 |

| 8 | USD Coin (USDC) | $1 |

| 9 | Polkadot (DOT) | $100 |

| 10 | Dogecoin (DOGE) | $1 – $1.20 |

Naturally, the crypto market is much larger, and there are thousands of altcoins that could be very good for investing, but we will get into that some other time.

The key to successfully trading with cryptocurrencies is knowledge. The more information you have, the better the chances you will be able to predict future behaviors.

I hope this article on the top 10 cryptocurrency predictions in 2022 has been helpful and please share it with your friends.

To your success!

S