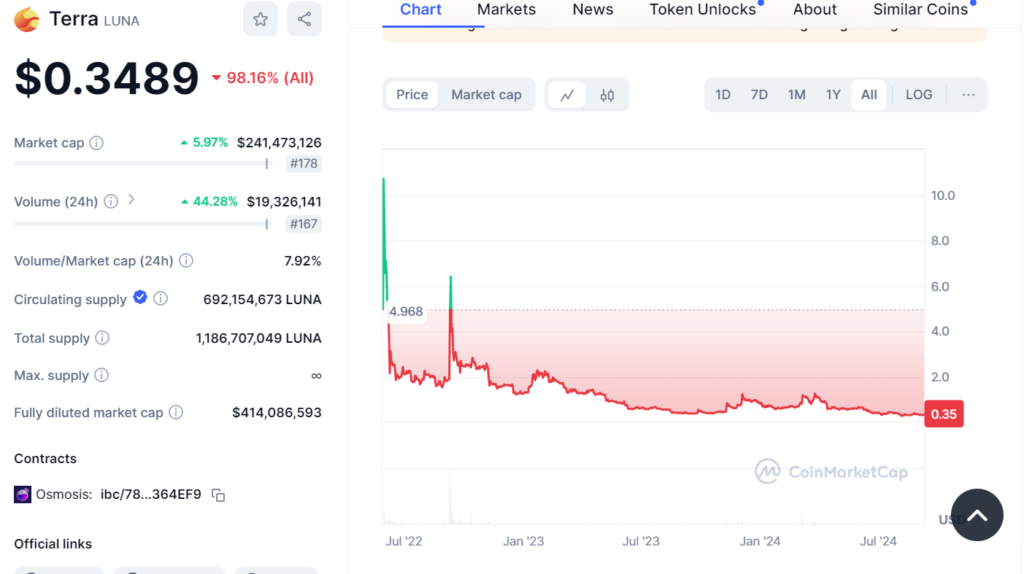

Terra Luna Price is currently hovering around the $0,34 mark. Let’s take a look at what Terra is and what are its advantages, disadvantages and price prediction.

What is Terra?

Terra is a blockchain protocol that aims to create a decentralized stablecoin ecosystem. Initially launched in January 2018, Terra’s mission was to leverage blockchain technology to build a scalable and efficient financial infrastructure.

The core of Terra’s ecosystem was its algorithmic stablecoin, TerraUSD (UST), which was pegged to the U.S. dollar. This pegging mechanism was achieved through a dual-token system involving Terra (LUNA) and UST.

The Terra blockchain uses a proof-of-stake consensus mechanism and is built on the Cosmos SDK, which provides scalability and interoperability with other blockchains. Terra’s platform allows for the creation and management of stablecoins that can be used in various decentralized finance (DeFi) applications.

How Terra Works

Terra operates on a dual-token system:

- 1 Terra (LUNA): This is the native staking token of the Terra blockchain. LUNA is used to collateralize the stablecoins and maintain their peg. It also plays a role in governance, allowing holders to vote on network upgrades and changes.

- 2 TerraUSD (UST): This was the algorithmic stablecoin designed to maintain a 1:1 peg with the U.S. dollar. It is minted and burned through a mechanism involving LUNA to maintain its stability.

The algorithmic mechanism involves expanding or contracting the supply of UST by burning or minting LUNA. When UST is above $1, users can burn UST to mint LUNA, thereby reducing the UST supply and bringing its price back to $1. Conversely, if UST falls below $1, users can burn LUNA to mint UST, increasing the supply of UST and restoring its peg.

Terra Luna Price: The Collapse and Rebirth

In May 2022, Terra faced a catastrophic collapse. The algorithmic stability of UST failed, leading to a massive devaluation of both UST and LUNA. This event, often referred to as the “Terra crash,” led to the creation of Terra Classic (LUNA Classic) and a new iteration of Terra (Terra 2.0), which rebranded and launched anew.

Terra 2.0 has since emerged as a community-driven project, distinct from its predecessor but carrying forward the core mission of the original Terra ecosystem. Unlike Terra Classic, Terra 2.0 does not include the algorithmic stablecoin mechanism.

Advantages of Terra

- 1 Innovative Stablecoin Model: Despite its collapse, the initial model of Terra offered a unique approach to stablecoin management using algorithmic mechanisms. This innovation aimed to create a decentralized and scalable stablecoin system.

- 2 Strong Community Support: Terra 2.0 benefits from a dedicated community of developers and investors who believe in its potential. The community’s enthusiasm can drive the development and adoption of the new Terra blockchain.

- 3 Ecosystem and Partnerships: Terra has a history of successful partnerships and integrations within the DeFi ecosystem. This includes collaborations with various decentralized applications (dApps) and financial platforms, which could support its recovery and growth.

- 4 Scalability: Built on the Cosmos SDK, Terra benefits from scalable infrastructure, which could facilitate its growth and adoption.

Disadvantages of Terra

- 1 Historical Instability: The collapse of the original Terra ecosystem has left a mark on its reputation. The failure of the algorithmic stablecoin UST raised concerns about the reliability of Terra’s financial mechanisms.

- 2 Regulatory Challenges: Terra, like many cryptocurrencies, faces regulatory scrutiny. The collapse has attracted attention from regulators and has led to ongoing legal battles involving its founder, Do Kwon. This uncertainty could impact Terra’s development and market perception.

- 3 Market Volatility: Terra’s price and overall market sentiment remain highly volatile. The project’s history has shown that it can be subject to sudden and severe price fluctuations, which can affect investor confidence.

- 4 Community-Driven Development: While community support is a strength, the lack of a centralized leadership structure could lead to inconsistencies in development and decision-making processes.

Terra Luna Price Prediction

At the time of this post being written Terra Luna Price was around $0,35.

Predicting the price of any cryptocurrency, including Terra, is inherently speculative and subject to significant risks. However, based on current market trends and analysis:

Terra Luna Price Short-Term Outlook:

In the immediate future, Terra (LUNA) could experience volatility as it continues to rebuild its reputation and infrastructure. Market sentiment and broader crypto market trends will play a crucial role in its price movements.

Terra Luna Price Medium to Long-Term Potential:

If Terra 2.0 successfully implements its plans and garners significant adoption within the DeFi ecosystem, it could see gradual price recovery. A reasonable best-case scenario for Terra might be reaching around $3 per LUNA, given the historical success of its predecessor and the potential for renewed investor interest.

Conclusion

Terra’s journey from its initial success to its dramatic collapse and subsequent rebranding highlights both the risks and opportunities inherent in the cryptocurrency space. While Terra 2.0 has a solid foundation and community support, it must navigate regulatory challenges and market volatility. Investors should approach Terra with caution, keeping in mind both its potential for growth and the lessons learned from its past.

If you’re not feeling confident about your crypto investing skills and knowledge, make sure to check out Copy my Crypto, which is the ideal platform for people who lack time or know-how when it comes to investing in cryptocurrencies. You can learn more about it here, on our Copy my Crypto review.

Happy investing!